ICBC Turkey Asset Management Second Variable Fund

SUGGESTED INVESTOR PROFILE:

Recommended for investors who want to benefit from the returns of various investment instruments with a dynamic management style.

ESTABLISHMENT DATE: 03.05.2000

FUND MANAGEMENT FEE: %2,00

RISK LEVEL: Mid - High

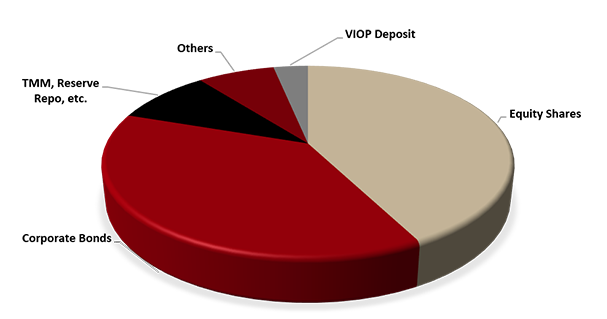

The Second Variable Fund focuses on generating returns by investing in various investment instruments with its dynamic management style and using derivative instruments effectively. The fund mainly aims to create savings in the medium term by investing in Reverse Repo-Takasbank Money Market Transactions, equities listed on Borsa Istanbul, short-term debt instruments, private sector debt instruments and mutual funds which invest in local and international markets.

The fund can also perform derivative transactions based on precious metals in futures markets for hedging or investment purposes.

Advantages

- Quick adaptation to market conditions with dynamic and flexible management style

- Within the framework of the strategic asset allocation model, medium and long-term stable returns with moderate fluctuations

BENCHMARK: 50% BIST-KYD Repo (Gross) Index + 40% BIST 100 National Index + 10% BIST-KYD OSBA Fixed Index