ICBC Turkey Asset Management Hedge (Fx) Fund

SUGGESTED INVESTOR PROFILE:

It is recommended for qualified investors who want to earn returns above USD deposit returns in the medium term.

ESTABLISHMENT DATE: 15.01.2019

FUND MANAGEMENT FEE: %1,00

RİSK LEVEL: High

The investment strategy of the Hedge(FX) Fund is focused on providing stable returns above deposit rates in USD by investing in Turkish public and private sector Eurobonds in USD, and also deposit accounts denominated in USD according to economic conjuncture.

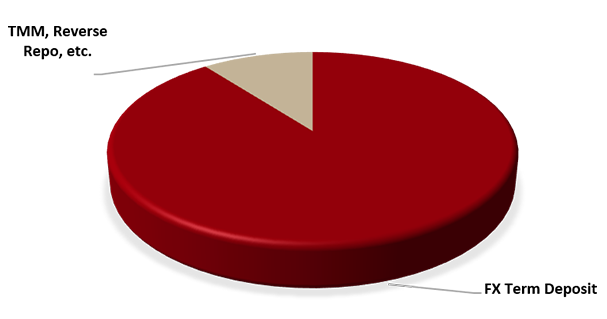

The Fund continuously invests at least 80% of its portfolio in USD denominated Eurobonds and deposit accounts. The remaining of the portfolio is invested in TL denominated fixed income securities such as money market securities and private sector bonds. The Fund rarely includes derivative instruments for hedging or investing purposes.

Advantages

- Yield potential on USD-based deposit yield

- Advantage of protection against possible devaluation of TL based fixed income securities investments.

BENCHMARK: BIST-KYD 1 Month Deposit Index (USD)