ICBC Turkey Asset Management Equity Fund

SUGGESTED INVESTOR PROFILE:

It is recommended to investors who aim to be more beneficial than the return of the BIST National 100 Index.

ESTABLISHMENT DATE : 13.10.1993

FUND MANAGEMENT FEE : %2,00

RISK LEVEL : High

The Equity Fund aims to earn a better return than the BIST 100 index by investing largely in stocks that perform relatively well in the BIST 100 index.

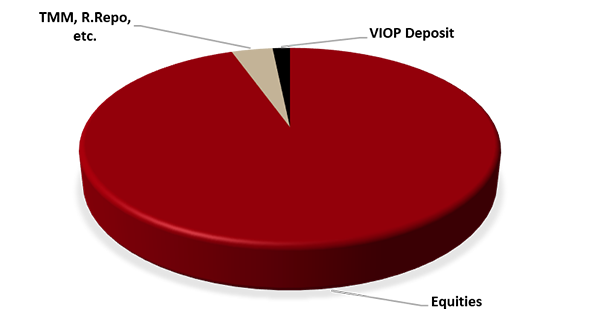

The fund continuously invests at least 80% of its portfolio in partnership shares traded on BIST. The fund can invest in Reverse Repo, Takasbank Money Market, TL-Foreign Currency Deposits, Turkey Public and Private Sector Debt instruments with 20% of its portfolio.

It can actively use derivative instruments for hedging and/or investment purposes.

Advantages

- Quick adaptation to market conditions with dynamic and flexible management style

- Potential to highly reflect the performance of the BIST 100 Index with a portfolio consisting of selected stocks

BENCHMARK: 90% BIST National 100 Index + 10% BIST-KYD Repo (Gross) Index